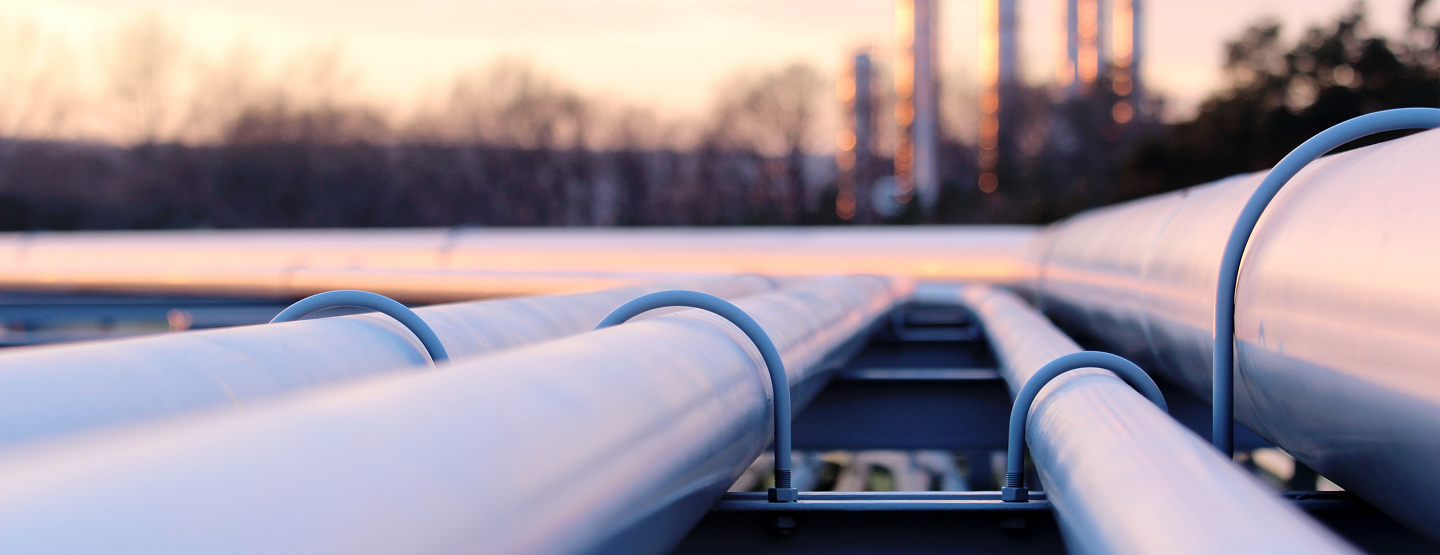

Carbon Management

Uncover profitable pathways to address emissions across industries.

Assess emerging pathways, de-risk capital investments, and deliver profitable decarbonization strategies.

Oil and gas companies face unprecedented shifts in the global energy system with conventional business models at risk. The age of AI, complex geopolitics, and rapid technological advancements are introducing new sets of promising opportunities to innovate and grow alongside novel operational risks.

By leveraging our in-house research, techno-economic models, and industry experience, FSX has helped clients navigate a variety of innovation and commercial viability questions, be it in upstream E&P, natural gas treatment, or green CO2 products. Through our tailored advisory services, we support leaders in the oil and gas industry across the following three priority areas.

Achieving robust, sustainable, top line growth by harnessing the power of emerging technologies, novel business models, and lucrative adjacancies to diversify.

Running brownfield and greenfield assets in a cost-effective, safe, and reliable fashion by embedding industry best practices, efficient supply chains, and digital transformation.

Maintain course on 2030 and 2050 corporate GHG reduction targets by deploying greener technologies and investing in promising, high-growth clean-tech startups.

The age-old energy trilemma is giving way to multiple growth levers for energy companies. From low-carbon natural gas and hydrogen derivatives to critical minerals and policy shifts - FSX helps upstream and integrated energy companies cut through complexity and define what’s viable, scalable, and commercially rewarding.

A reliable energy system that withstands and rapidly recovers from supply dynamics.

An energy system that is affordable, accessible, and enables long term economic growth.

An energy system that is low carbon, efficient, and safe for workforces and societies.

The global energy policy landscape is more volatile than ever as countries offer a host of incentives to secure future supply.

The rise of clean-tech, and digital transformation presents a universe of novel technologies for energy companies to adopt and venture.

The evolving energy system is rapidly stitching power, O&G, and critical minerals into a single ecosystem, laying pathways to diversify and integrate.

Leverage energy subsidies and re-onshoring incentives to spur new businesses, example: ongoing US tariff system.

Consider deploying emerging low carbon technologies in conventional assets, like SMRs to power remote upstream sites.

Expand beyond the realm of legacy offerings; tap into the connected value chain of critical minerals or diversify into new product offerings.

Our proprietary six-lens approach enables sustainable growth by decoding policy impacts, envisioning technology convergence, modeling techno-economic shifts, fostering strategic partnerships, leveraging digital transformation, and optimizing supply chain feasibility.

Impact assessment of global climate policies, trade tariffs, and incentives for the energy sector.

In-depth analysis of innovations across the O&G value chain; from the digital oilfield to novel E&P production technologies.

Economic feasibility assessment of large-scale, capex heavy technologies like green hydrogen and CCUS.

Assessment of latest advancements in oil & gas pipelines and shipping infrastructure for emerging cross-border trade.

Nuanced asset level use case mapping for emerging digital solutions like digital twins and AI alongside ROI measurement metrics.

Identification of high-growth startups and industry participants to engage, be it for venture investing to strategic collaborations.

Team of engineers and technologists, business strategists, techno-economic modelers, and industry veterans.

End-to-end value chain coverage of oil & gas industry: building blocks, intermediates, commodities, and specialties.

In-house research portals (Data Center Intelligence, Carbon Management, Energy Transition, BioScaleX).

In-house benchmarking and simulation tools (Opportunity Cube, S-curve Analysis, Manufacturing Profitability Model).

Robust industry network

Oil & gas companies must simultaneously reduce emissions, navigate energy transition dynamics, and optimize traditional operations. FutureScaleX provides the strategic foresight and economic rigor to help leaders protect core assets, explore new energy frontiers, and transition profitably over time.

Design creative, lasting, business models that tap on emerging digital and deep-tech technologies.

Visualize comparitive performance, best practices, and leaders in various market segments for strategizing future success.

Develop a lasting, holistic, action plan for abating your scope 1 and scope 2 emissions; going beyond setting an aggressive reduction target.

Conduct technical, financial, and regulatory evaluation of promising startups developing innovative technologies in sustainability.

Streamline your offering for long-term growth by identifying high potential product-lines, new regions to target, and optimizing R&D to innovate technologies poised for growth.

Evaluate the potential implications, be it benefits or risks, of latest regulatory developments in sustainability both for your business and key regions of interest.

Deep techno-economic analysis of engineered carbon removal solutions mapped to your growth, innovation, and emission reduction strategies.

Explore how we've helped energy leaders with portfolio growth, operational excellence, and sustainable growth objectives, turning complex challenges into tangible results.

.png?width=387&height=234&name=image%20(48).png)

Helped energy supermajor refine its R&D strategy for green hydrogen, identifying white spaces.

.png?width=387&height=234&name=image%20(49).png)

Partnered with a European oil major to develop a capital allocation strategy for CO2 utilization products.

Provided a global integrated utilities player with a low carbon pathway for its natural gas business.

Supported a global gold miner in formulating its climate physical and transition risk mitigation strategy.

Helped energy supermajor refine its R&D strategy for green hydrogen, identifying white spaces and hyper-competitive segments.

Supported a global certifications player in developing a roadmap for Power-to-X/E-fuel adoption in Asia-Pacific.

From low-carbon natural gas and hydrogen derivatives to critical minerals and policy shifts - FSX helps upstream and integrated energy companies cut through complexity and define what’s viable, scalable, and commercially rewarding.